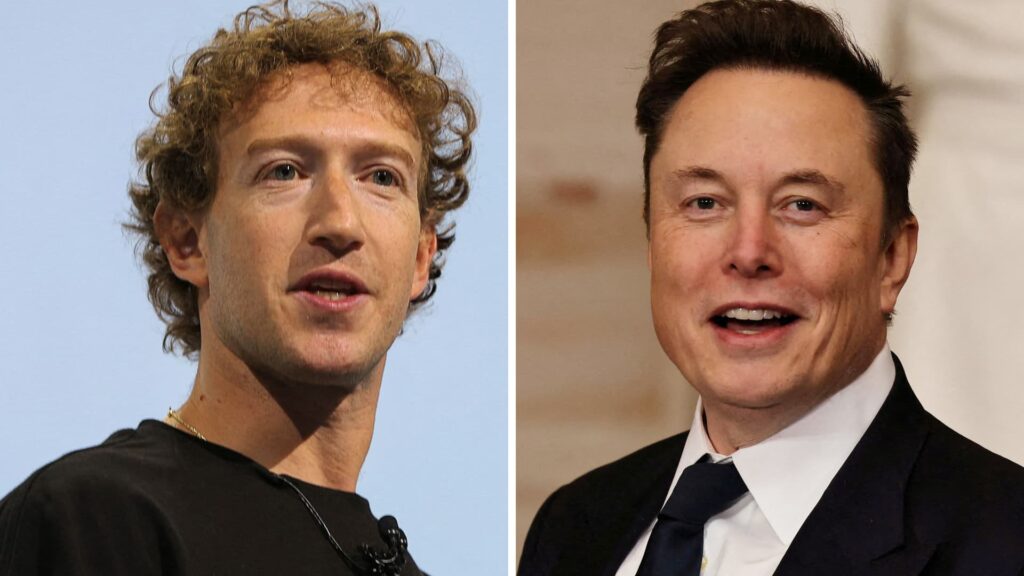

META CEO, Mark Zuckerberg and Tesla and SpaceX CEO, Elon Musk

Manuel Orbegozo | Chip somodevilla | Reuters

After the news broke on the last day of January Meta Matt Meyer, who could be incorporated into another state following Elon Musk’s lead to escape from Delaware, took action.

Delaware has long been the dominant state for US companies because of its flexible corporate code and professional judiciary. Over 20% of state tax revenues amount to over $1 billion a year, but historically it has been born from corporate franchise fees, state lawmakers can’t afford to preside over mass escapes, or what they call “Dexit.”

On Saturday, February 1st, the day after the Wall Street Journal released its Meta story in consideration of Delaware’s departure, Meyer, the perfect fit for the job, convened an online meeting with lawyers at a law firm representing Meta. Tesla Other people in shareholder disputes in the state, according to public records obtained by CNBC. Other attendees included members of the Delaware Legislature.

The purpose of the meeting was to have a “Discussion Re: Corporate Franchise.”

The next day, records show that Meyer invited a second group to meet with him and the new Secretary of State Charuni Patibanda-Sanchez. The invitation was sent to Kate Kelly, Meta’s corporate secretary, and Dan Sachs, the company’s senior national director of state and local policies.

The invitation also went to James Honaker, an attorney for Morris Nichols, a company representing Delaware federal court meta, and William Chandler, the former prime minister of Delaware, who is now part of Wilson Sonsini’s Delaware lawsuit.

About two weeks later, Delaware lawmakers were asked to vote for the bill known as SB 21. This required overhauling the state’s laws in a way that could support Musk, Mark Zuckerberg, and other controlling shareholders of large corporations, if enacted.

Among other things, SB 21 changes the way in which transactions made by a company using independent directors are not subject to court scrutiny and limits the records that shareholders can obtain when investigating possible violations of fiduciary obligations.

Later last week, the state Senate voted to pass the revised version of SB 21. If Delaware’s House of Representatives follows the lawsuit, the bill will be at the governor’s desk and signed into law in a expected vote Thursday.

This could remove the large overhangs of Zuckerberg and Meta.

Meta has been the subject of the “book and record” investigation in recent months, according to two people directly involved in issues that were asked not to name them to discuss private investigations. According to people seen by CNBC and Delaware records, current law allows the shareholders behind these probes to file cases in which Zuckerberg or other metadirectors allegedly caused billions of dollars in damages.

If SB 21 passes, any claims filed after February 17th, the date the bill was brought to Congress will be considered under the new law. This means that shareholders will not benefit from current law and the investor protections that come with it if a new claim is being considered in Delaware courts.

A Meta spokesman declined to comment.

Meyer spokesman Mira Miles said in a statement that the governor had spent his first few weeks at a job offer with “plaintiffs’ lawyers, Delaware attorneys and countless Delaware transfer companies,” and had not bid for billionaires.

I’m helping Trump

Musk grabbed the public’s attention in 2024 after deciding that $56 billion in Tesla packages from 2018 were illegally recognized and should be withdrawn. He wrote to X that he would never incorporate your company into Delaware, then moved to Texas, denounced the judge behind the “absolute corruption” verdict.

Musk also became the top donor of Donald Trump’s presidential election and is now his White House chief advisor and runs the so-called government efficiency.

Zuckerberg, who had a particularly rocky relationship with Trump during his first term as president, has a favour for the round. He took steps such as ending the meta diversity, equity and inclusion, or DEI, the program, eliminating third-party fact checkers in favor of the “community note” model used by the X platform of Musk, and adding Dana White, the ultimate Fighting Championship CEO and longtime friend of Trump, to his company’s board of directors before launching a new administration.

Mehta also agreed in January to pay $25 million to settle a lawsuit four years ago over the company’s decision to suspend Trump’s accounts after the January 6 Capitol riots.

News that Zuckerberg was considering moving from Delaware have landed more than a week after Trump took office, where Meta’s CEO attended alongside other technology leaders.

Mark Zuckerberg arrives before Donald Trump takes office on Monday, January 20, 2025, as the 47th President of the United States takes place inside the Capitol building in Washington, DC.

Kenny Holston | Via Reuters

Meta has not publicly commented whether it plans to reincorporate it outside the state.

As CNBC previously reported, the authors of SB 21 included Richards, Leighton & Finger, a corporate defense company that counts Musk and Tesla as clients. It was co-authored by Professor Lawrence Hammelmesh of Delaware Law School, former Prime Minister Chandler and former Delaware Supreme Court Judge Leo String.

Strine works for Wachtell, Lipton, Rosen and Katz and represents Zuckerberg on another issue related to the company’s involvement in the 2018 Cambridge Analytica scandal. In 2019, META agreed to pay a $5 billion fine to resolve claims related to the Federal Trade Commission.

SB 21 was introduced to the Delaware General Assembly in mid-February, with Senate majority leader Brian Townsend attending the first of two Meyer meetings. The process of drafting the bill did not follow the traditional Delaware practice of changing legal laws, which usually involves writing and review by the state’s bar association.

The reforms outlined in SB 21 are supported by corporate defense companies and lawyers, including those who helped draft the bill. They are vocally opposed by shareholder lawyers and investment groups, including Calpers and ICGN, and say that the controlling shareholders want to avoid self-interest transactions and decisions that go against the wishes and rights of a broader investor base.

On February 2nd, Miles from the Governor’s Communications Office shared a note with lawmakers and lawyers who attended the weekend meeting. It included a list of issues in the defense of SB 21.

A memo obtained by CNBC said Delaware takes pride in having “the best law and law” as “the home of the world’s leading companies” and “the home of America’s leading companies,” which continues to be “the best destination for business organizations.”

“No matter the size, whenever an entity leaves Delaware in one of their sisters’ jurisdictions, our goal is to get their business back,” the memo said. “Companies that are often reconfigured from Delaware returns to Delaware.”

Read the public records here: