The market holds breath

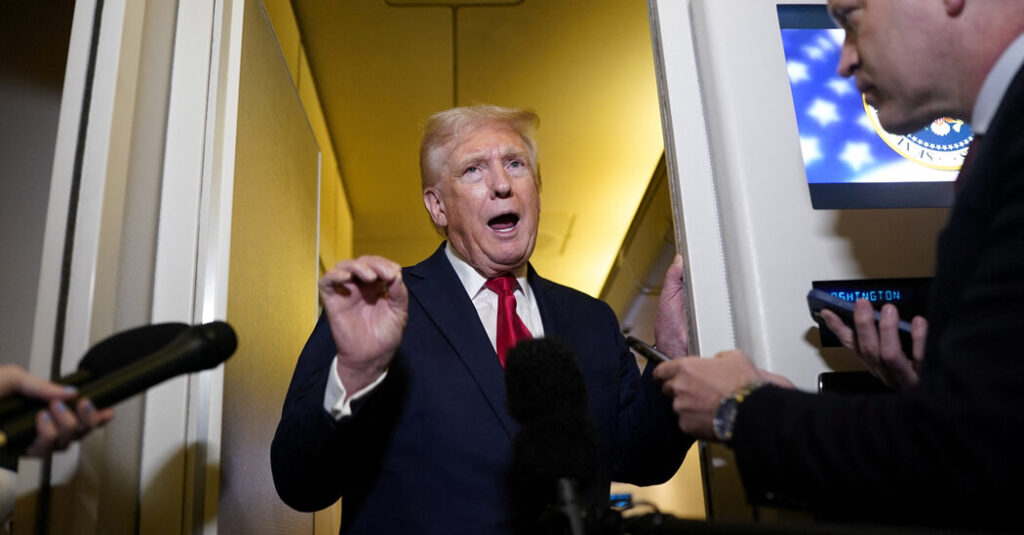

Investors are taking a bit of breath on Monday, and the market is gathering in Asia and Europe in hopes that it will not be blessed with high-tech tariffs. Optimism seems to contradict President Trump’s own words.

The president shows yet another taxation is ongoing, with more confusion about what is happening among business leaders, what is off, and how to deal with their new reality.

Has Trump undermined his own position? If tariffs are actually bodied, it could erode his bargaining power – he is trying to reclaim production on the US coast, not to mention his argument that high-tech imports fall into a special national security category.

Latest: Businesses are supporting new Trump tariffs this week with chips and high-tech components that power cell phones, computers and other consumer gadgets. The president also made a Friday announcement by his administration, sparing many of the same popular electronics from penalizing taxes. “No one is ‘off the hook’,” Trump posted on True Social, saying, “We’re not the worst dealing with it, not particularly China!”

Tensions with Beijing are rising. Chinese leader Xi Jinping shot on Monday with Trump’s increasingly protectionist policies ahead of his tours in Cambodia, Malaysia and Vietnam (a country that has become an essential supplier to American companies). “The tariff war will not develop winners,” Xi said.

Long-term standoffs can destabilize the global supply chain, analysts warn. XI can “wait the US,” Norielle Rubini, an economist and senior advisor at hedge fund Hudson Bay Capital, told Bloomberg Television on Monday. “In the short term, China has a lot of leverage,” he added. This puts trade restrictions on companies such as Apple and Tesla.

The market is bounced back. Nasdaq futures are set to open on the green on Monday, with Apple gathering in pre-market trading. But last week’s big loser, The Dollar – sold out again, hitting a six-month low, adding concern to importers.

Larry belays on a growing list of questions. When will customs escalation stop? Will the White House agree to sculpture of a particular industry or product? In the meantime, how do companies price their products and plan their investments?

Business leaders are worried. A poll conducted last week by the Chief Executive Journal found that CEO confidence was at its lowest level since spring 2020, the early days of the coronavirus pandemic, Dealbook first reported. Of the 329 company heads surveyed:

76% believe that tariffs are negatively affecting their business.

26% plan to increase CAPEX spending, down from 37% in the March survey.

62% predict a slowdown or recession over the next six months.

“I support bringing more manufacturers back to the US, but this is not a way to do that,” Peter Ensch, CEO of Sani-Matic, a manufacturer of Wisconsin cleaning systems, said in a study. “Starting a trade war with our closest allies and business partners is simply bad business.”

This is what’s going on

Goldman Sachs stocks will skyrocket on buyback plans and solid first quarter results. The Wall Street giant said it approved the board approved the purchase of stock worth up to $40 billion as it defeated analysts’ estimates on profits and revenues. Strong trading revenues offset the decline in investment banking units.

Police arrested the suspect after the Pennsylvania governor’s mansion burned up. The 38-year-old man was charged with murder, arson and terrorist attempts after Gov. Josh Shapiro’s home began to burn, while he and his family were sleeping there early Sunday morning. The fire adds to growing concern among voters over violence against elected officials.

New details reportedly appear in a deal to buy Li Ka-Shing’s port assets. The Geneva-based terminal investment will negotiate with the purchase of 43 ports from the Hong Kong billionaire company CK Hutchison, a company reported by Bloomberg, and acquire minority stakes in two other two around the Panama Canal that BlackRock is negotiating to acquire. The deal has been under intense scrutiny from Beijing and Washington.

Facebook goes to court in antitrust trials

The groundbreaking case for Facebook’s parent Meta begins when a federal judge determines whether social networks have violated anti-Monopoly laws. CEO Mark Zuckerberg was able to testify immediately on Monday.

Here’s what you need to know: The federal government accused Meta of illegally applying exclusivity rights when it acquired Instagram and WhatsApp. Regulators call it a “purchase and fill” strategy.

Meta argues that Facebook is already competing with popular apps like Tiktok and Snapchat, and that the constantly changing power of the internet often breeds new competitors. Artificial intelligence is already improving how people interact with technology. The company also says it has invested heavily in developing apps that are bigger than most people imagined.

The case, which is expected to last several weeks, is being heard in the U.S. District Court for the District of Columbia by Judge James E. Boasberg, appointed under George W. Bush and considered moderate.

What does Zuckerberg do about it? The Facebook founder who has become more friendly with President Trump (for example, donating $1 million to his first fund) is lobbying for a settlement. He frequently traveled to Mar-a-Lago to present his case and promoted Republican Joel Kaplan as the company’s policy director to strengthen ties with Washington. He also appointed former Trump adviser Dina Powell McCormick to the board. Zuckerberg’s political efforts have not ended the case so far, but settlements are always possible.

The stakes are expensive. Meta could be forced to spin off or sell Instagram and WhatsApp. And it could have a completely calm effect on the merger. The flow of M&A activity has quieted under Trump, the opposite of what investors had expected. Government victory will change the landscape of mergers and allow us to set far more strict standards for trading.

FTCs face difficult tasks, legal experts say. Agents are trying to prove the hypothesis that Facebook is not so dominant if they don’t get these apps. But it also has rare, bipartisan support, as both lawmakers believe that tech giants like Meta are becoming too strong.

It’s not just meta. The government won a massive anti-trust fight with Google last year, with the Department of Justice suing Apple for anti-competitive practices, claiming that its device and app network is coding to allow consumers to use Apple services only.

Climate activists hit the pause button

The Oil Giants step into the start of their proxy season this week, trading near the lowest in four years between stocks and global benchmark Brent crude.

But for the first time in nearly a decade, major climate activists have not been cutting emissions and pushing harder for the transition to clean energy because of President Trump’s actions to silence climate action.

This was followed by a group of Dutch climate shareholders who had been ravaging energy companies for many years, sweeping away their actions, retreating from campaigns to submit proxy resolutions, and predicting an inactive response from investors.

The new SEC guidelines for strict shareholder proposals have already had the effect of muzzle. (Morningstar hopes to see a 40% drop this year in a resolution aimed at environmental, social and governance issues, the company told DealBook.)

Follow This founder Mark Van Baal spoke about his organization’s decision at this year’s annual general meeting. The group has achieved a major victory, but in recent years it has faced a series of DUD votes.

The interview was compiled for Brevity.

Why did shareholder resolutions have been suspended this year?

Since 2016, we have been able to acquire four supermajors to set emission reduction targets. That’s something they absolutely didn’t want to do. The war in Ukraine then began to fight back due to high oil prices. It has won 20% of the votes for the third year in a row. I thought, “OK, it’s not effective.”

What factors did Trump play in your decision?

Donald Trump and the SEC under Trump make it impossible to file a resolution. They call our kind of solution micromanagement.

A state suing investors for considering Trump’s election and climate risks that have been added to investor uncertainty. They fear that they could be sued considering climate risks.

The SEC’s new guidelines enforce passivity on investors. Investors do not want to face conflict with companies, they must stand up to the companies. In Europe, regulators are not appointed by politicians. We hope that investors will join us.

What will be next for an activist shareholder like you?

Institutional investors have only one important action – Voting at AGM

We are pausing to talk to them. BlackRock at Norges Bank and Legal & General, for example, has always said he wants to tackle the climate crisis. But when the push sticks out, they don’t use the vote.

Deal Book Series: How tariffs are affecting US business

“Guns to the heads of all American companies”

We asked Dealbook readers how tariffs affected their company. Today we’re featuring responses from Danny Muscat, owner and SVP of Deer Staggs, a family-owned footwear company based in New York.

He writes:

For a company like me, a small, private wholesale shoe company, we are totally paralyzed. It is an existential crisis.

We make shoes in China and cannot bring items with 145% tariff in addition to our regular duties. There are several cost receipts of about $1 million as the vessels will be shipped over the next few weeks. When they were purchased, our budgeted obligation was $60,000. With the new duties, you will have to pay $1,510,000 to settle customs for these items. It simply cannot be paid.

We have suspended the cargo and most of our retail customers are doing the same thing. Other brands too.

We cannot afford to buy tariffs – we could make us bankrupt today – and we can’t afford not to have any goods that could make us bankrupt tomorrow. We are trying to move production, but that takes time and money. And when no one knows the conditions for importing from another country from one day to the next, how do you do it? Manufacturing in the US is completely unrealistic and requires 5-10 years of national investment in any case.

This Trump Trade War is a chicken game where you get “negotiated” with guns on the heads of every American company like me.

Dealbook wants to hear from you

I’d like to know how tariffs are affecting your business. Have you changed your supplier? A low price negotiated? Have you suspended your investments and employment? Have you planned to move manufacturing to the US? Please tell me what you are doing.

Next week

Bank revenues should provide new clues about the finances of American households and businesses. This is what you should look at.

Tuesday

Bank of America and Citigroup are the next big banks to report on.

Wednesday

Federal Reserve Chairman Jerome Powell is set to give a speech at the Chicago Economic Club, with swirling questions about inflation and interest rates. Elsewhere, United Airlines will release the results.

Thursday

The European Central Bank is expected to cut interest rates. This is the latest central bank to do so in the wake of President Trump’s trade war. Revenue Calendar: UnitedHealth Group, Netflix, Blackstone.

Speed is read

transaction

Brookfield hopes to raise more than $2 billion for a fund focused on the Middle East. (Bloomberg)

The Norwegian Sovereign Wealth Fund will support the bid for Banca Monte Dei Paschi Di Siena to buy Mediobanca, a large rival to Italian lenders. (Bloomberg)

Politics, policy, regulation

Maya Angelou is out, but the “main camp” will remain on the library shelf at the US Naval Academy after a review by Defense Secretary Pete Hegses. (NYT)

The defamation loss lawsuit in Sarah Palin’s era is ongoing in a trial that can test journalists’ First Amendment protections. (NYT)

Best remaining

I want feedback! Please email your thoughts and suggestions to dealbook@nytimes.com.