Your support will help us tell the story

From reproductive rights to climate change to big technology, the independence is on the ground when stories develop. Whether you’re researching the finances of Elon Musk’s Pro-Trump PAC, or producing the latest documentary, The Words, we shed light on American women fighting for reproductive rights, but we know how important it is to analyze facts from a message.

At such a crucial moment in American history, we need a reporter on the ground. Your donation allows us to send journalists to continue talking to both sides of the story.

Independents are trusted by Americans throughout the political spectrum. And unlike many other quality news outlets, we choose not to lock Americans from reports and analytics using paywalls. We believe that quality journalism should be available to everyone who is paid by those who can afford it.

Your support makes all the difference.

read more

The US is approaching a formal economic recession and may face much worse on the horizon, billionaire investment expert warned on Sunday.

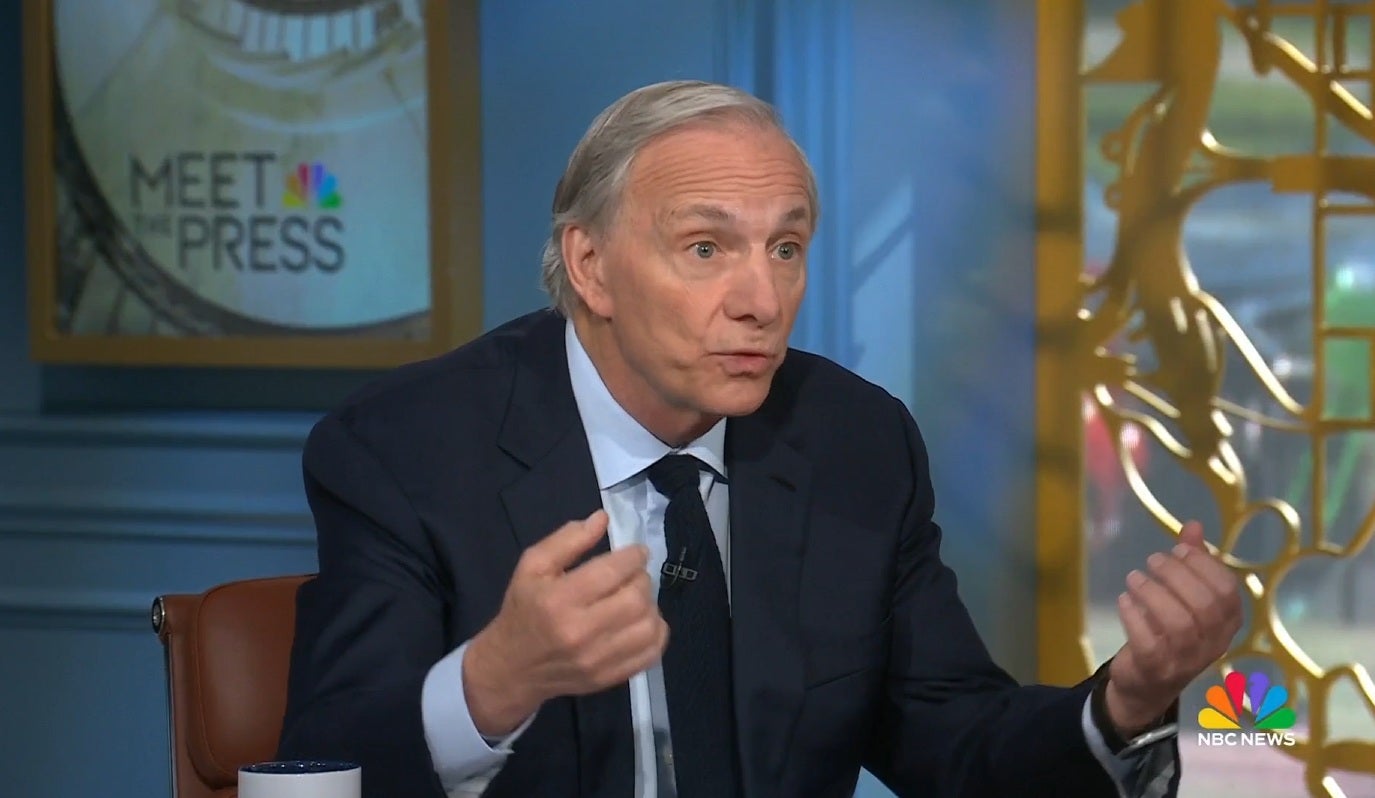

Bridgewater Associates founder Ray Dalio appeared on NBC’s Meet the Press and warned that the “disruptive” nature of Donald Trump’s tariff announcement has caused market instability, making it difficult for both American business and global trading partners to rely on the United States.

A Wall Street veteran who predicted the collapse of the housing bubble in 2008 caused a financial crisis that year, and Dario told NBC’s Kristen Welker that his chance to stop “a lot worse than the recession” took what the White House described as the president’s advisor as his end goal.

“We have a big change in the domestic order (…) and a big change in the world order. Those times are very similar to the 1930s,” Dario said.

“Therefore, if you take tariffs, if you are taking debt, if you increase the power to challenge existing forces, if you take those factors, the changes in the order, the system are very, very destructive,” he continued. “How it is handled can produce something much worse than the recession, or it could be handled well.”

Dario, who has a net worth of $14 billion, has repeated what he has warned several times. He believes that US federal debt currently in excess of $36 trillion is a time bomb that will hinder future US spending and ability to borrow.

“We’re breaking down financial order,” warned Dario. “We’re going to change the financial order because we can’t spend the amount.”

Images opened in the gallery

He continued: “I believe that members of Congress should pledge what I call a 3% pledge. In some way, I will lower that budget deficit to that number. Otherwise, I will have these other issues as well as the debt demand/demand issues.

His warning comes days after instability in the stock market, driven by the plunge in tech stocks and other industries hit by new White House tariffs, and is plagued by the ever-changing nature of the policy itself.

On Friday evening, Trump’s Customs and Border Protection Agency issued a notice waived smartphones, solar cells and other imports associated with the US technology sector, both from China’s “mutual” tariffs and his low baseline tariff rate tariffs of 10% on all imports. It was a victory for companies like Apple, but died Sunday when Howard Lutnick’s Secretary of Commerce warned that these tariffs would be reimposed within a month or two.

It remains unclear whether the president will put the remainder of his highly misused “mutual” tariff rates on dozens of US trading partners, including the EU, Japan, Canada and Mexico, or whether Trump will be back down in part or overall in recent repetitive cases. Trump Ministerial officials and White House advisers were unable to give a clear answer as to whether those tariffs or the president’s overall 10% tariff rate was a simple negotiation tactic and could remain for the duration of his term.

Images opened in the gallery

Other industry leaders are aware of what White House officials repeatedly argue. That means that tariffs are at least half-major as the president tries to force US companies and foreign investors to produce and manufacture the US onshore in order to ensure sustainable access to the US market.

Felix Stelmuszek, the global leader in global automotive and mobility at Boston Consulting Group, told CNBC on Saturday.

“This could be the most consequential year for the automotive industry in history, not just because of immediate cost pressure, but because it forces fundamental changes in the way and where the industry is built.”