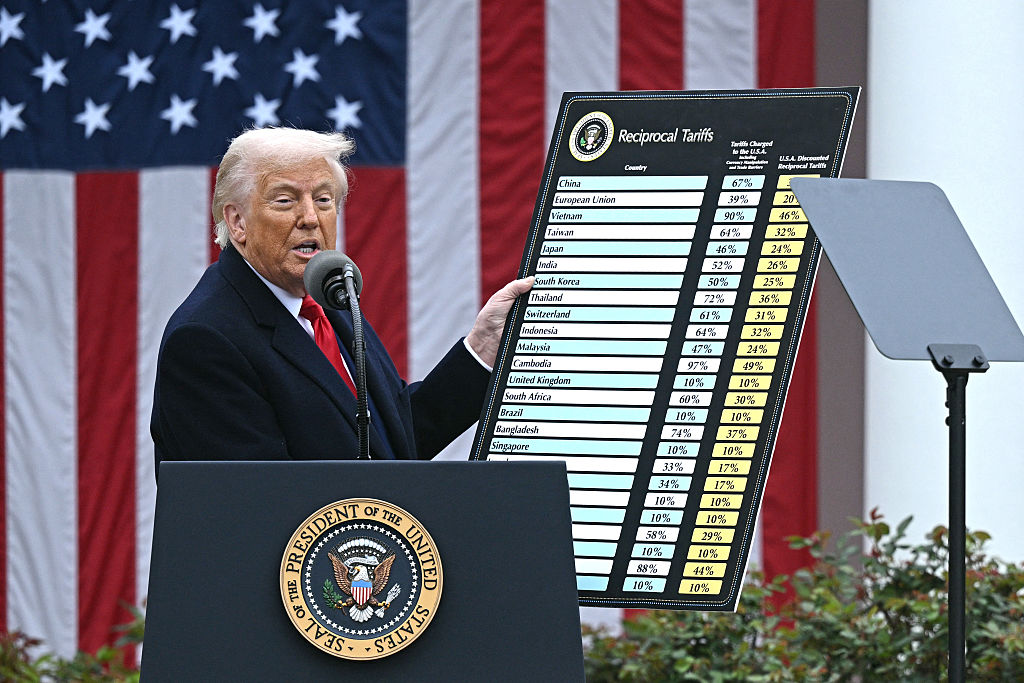

President Donald Trump’s tariff plans are moving forward by collecting taxes on imports that economists warn. It leads to rising consumer prices, which complicates the Federal Reserve’s efforts to boost inflation higher and stabilize the pace of price growth.

With Trump’s plans for additional mutual tariffs on US trading partners, as well as sector-specific tariffs such as Trump’s plan for additional mutual tariffs on US trading partners, as well as a 25% tariff on current imported vehicles and auto parts, tariff-related prices may be immediately reflected in inflation data monitored by FED.

Ryan Young, a senior economist at the competitive Enterprise Institute, told Fox Business he expects it will be “about six weeks” before prices rise as tariffs begin to affect inflation data.

“If we assume Trump will pass mutual tariffs with cars in early April, prices for many items should rise soon. That will be visible in the CPI and PCE releases in April,” he said.

The 25% tariff on Trump’s imported vehicles and auto parts is expected to take effect on April 3rd, and car rates could be quickly passed on to consumers. JPMorgan’s analysis found that “automobile manufacturers can pass most tariffs given their powerful pricing capabilities,” and that those car rates “will increase vehicle prices by about 5%.”

“We expect the increase to be clear soon as tariffs appear to take effect next week. We expect an increase in inflation to pressure actual disposable income growth to under 1% for the next quarter, presenting a significant headwind for consumption growth,” the analyst wrote.